The central gateway for submitting summary declarations to Customs.

How do I submit a T2L(F) document via Cargo Declaration Import?

This is done in the same way as you did for the Proof of Union Status (PoUS) scheme. You can submit your Cargo Import Notification in two ways:

In both cases:

Notification Import Documentation (NID)

It is important that the MRN number you use is also specified in the Notification Import Documentation (NID) service. For more information about this, click here.

Q&A PoUS from Dutch Customs

Click here for the full Q&A regarding PoUS from Customs Netherlands.

2024 February – PoUS Q&A

Portbase and the Dutch Customs had organised a meeting concerning changes that are in effect after 01-03-2024. We hereby share all questions and answers we received that day and divided them by three subjects.

Changes in T2L(F) cargo declaration

Q1: When does PoUS (Proof of Union Status) come into effect?

A1: PoUS is the new European information system with which Customs automatically issues and checks Union status certificates T2L(F) and will come into effect from 1 March 2024. The new registration rules apply from that date. T2L(F) Union status certificates have a validity of 90 days.

The MRN (Master Reference Number) that you receive upon registration must be stated in the ATO (Temporary Storage Declaration). From this date you cannot email/send T2L(F) forms in PDF to the Entry and Exit Department of the Rotterdam Maasvlakte customs office (hereinafter abbreviated as BU) of Customs.

BU manually reports the arrival in PoUS of the T2L(F) goods and Customs later checks the legality of the T2L(F) proof. Customs' customer management department does the latter.

From Q3 2025, the customs manifest will also be registered in PoUS. At that time, Permit TC 12 (Permit for drawing up a shipping manifest after departure) will also expire and can no longer be used.

Q2: Does this apply to incoming and outgoing cargo of Union goods to and from the Netherlands?

A2: Yes, for incoming cargo you will receive a T2L(F) MRN from your overseas partner. For outbound cargo, you supply a T2L(F) MRN to your overseas partner.

Q3: Does the Netherlands have any adjustments to the European regulations?

A3: No, all Union countries apply the same rules and policies.

Q4: Do I also have to register the T2L(F) in the ATO as of March 1, 2024 if this certificate was issued on paper before March 1?

A4: The current method of registration in the ATO for Union status certificates issued on paper before 1 March 2024 remains unchanged. You register this as C status and keep a paper copy.

Q5: How should I handle T2L(F) Union Status Certificates issued on or before February 29?

A5: Due to the validity of 90 days, the current regulations surrounding these T2L(F) Union status certificates are sufficient. After May 29, 2024, the old procedure will no longer apply.

Q6: Is there a European emergency procedure known if the PoUS system is not available?

A6: No, there is no emergency procedure known at this time. Dutch Customs is currently collecting all feedback and sharing it with TAXUD (Taxation and Customs Union Directorate-General).

Q7: What must be registered for outgoing Union goods to receive an MRN?

A7: TAXUD does not yet have work instructions available, which will only be available after March 1, 2024. Dutch Customs is now developing work instructions, with the aim of releasing them in week 7, 2024 via redactie.nl.

Q8: No information is yet available from other EU countries, the deadline is the same. Why wasn't this announced earlier?

A8: This will differ per EU country. The Netherlands also noticed this late. However, we are now working with Portbase on its implementation. Dutch Customs has drawn up a FAQ list and posted it on redactie.nl and this will be maintained together with input from Portbase.

Q9: What can I do with my current TC12 permit until Q3 2025?

A9: The Permit TC12 (Permit for drawing up a shipping manifest after departure) will expire in Q3 2025. Until then, the permit can be used, as long as the goods are registered as C status. If you intend to apply for this permit, you must decide for yourself whether it is still worthwhile.

Q10: We jointly developed the Maritime Single Window, but Dutch Customs has now opted for a separate system for the registration of Union status certificates. We will soon also be dealing with ICS 2.0, why is this not being brought into line?

A10: The use of PoUS for Union status certificates T2L(F) and soon the customs manifest is a European obligation. This is also the case with the use of ICS 2.0. In the European Union, new policies for electronic procedures have been established in the Multi-Annual Strategic Plan for Electronic Customs (MASP). Customs Netherlands has no influence on the timelines set for this.

Q11: This process has no effect on Union goods that concern NL-NL?

A11: Correct. No proof of Union status is required for this transport.

Q12: No C status is stated for Union goods in the ATO. I am not a shipping company/shipbroker and am therefore not allowed to mention ICT and the MRN of the Union status certificate in the MID. How do I get the Union goods from the RTO?

A12: The procedure for this situation before March 1, 2024 will not change. There is one difference, you do not have a paper proof of Union status. You only have one MRN. You contact the Entry and Exit Department of the Rotterdam Maasvlakte customs office. They report the arrival of the Union status certificate in PoUS based on the MRN. The CWP (Central Work Point Customs) unblocks the Union goods. With a fiat removal you can remove the Union goods from the RTO.

Changes in control of T2L(F) cargo handling

Q13: In the ATO, the B/L must be registered as C status with the T2L(F) MRN, is this to check whether the MRN is valid?

A13: No, Customs manually reports the arrival of the T2L(F) goods in PoUS. This is not to check whether it is legal, but to ensure correct debiting of the ATO.

Q14: MRN validation (checking validity) is currently not possible, registration of the MRN in the ATO is not a valid burden of proof. How can we manage and control this? Isn't it better for me to register as non-Union goods (T1) or Union goods and provide evidence afterwards?

A14: In the T2L(F) MRN, the 17th letter is a 'P'. The letter 'P' indicates that it is a Union status certificate registered in PoUS. This is not sufficient to check the validity of the MRN. You can use the MRN to search the PoUS system. If desired, you can make mutual agreements with the permit holders of Authorized Issuer Permit - ACP, such as providing a printout of the Union status certificate from PoUS for your administrative workload.

The MRN has the following structure:

Example is: 23NL000702C00004P0

Q15: With the arrival of an MRN registration for Union status certificates T2L(F), the process becomes compliant with MRN as we know it for other customs declarations and that is a positive development.

A15: Correct.

Q16: Who is responsible if there is an error in the registration process? For example, a typographical error in the MRN number or an unlawfully issued Union status certificate?

A16: The submitter remains responsible for correct administration.

Q17: What if the Union Status Certificate is not reported in PoUS within 90 days before arrival? And is it registered as C status on the ATO?

A17: A shipbroker is responsible for his ATO and Customs will ask for proof.

Q18: How does Customs check the legality of the Union status certificate? Is paper administration still required?

Q18: This takes place digitally from the PoUS system. No paper file is required for evidence registered in PoUS. You are free to make separate agreements with the permit holders Authorized issuer permit - ACP for a paper version (print from PoUS) for your own administration if desired.

Automation options

Q20: How do we register a T2L(F) Union Certificate of Status?

A20: In the EU Customs Trader Portal with eHerkenning level 3, which can be registered in both Dutch and English. No automation is currently possible from your own systems and the EU Customs Trader Portal. You can make prints from this portal to share with third parties.

Q21: This will be manual work. Creating a T2L(F) will be an automated process for many parties before March 1, 2024. The data from a declaration for release for free circulation (import - IM4) is used to automatically draw up a Union certificate of status T2L(F). Can Portbase help us digitize this process?

A21: Yes, but that is not foreseen and impossible in the current timeline. TAXUD has not yet provided clarity on any further development of further optimization/automation. Dutch Customs hopes to provide this feedback as quickly as possible.

Q22: Can I also work with codes in my ATO, such as code 27 for Transhipment? And then automatically process messages?

A22: No, not at the moment. The operation of REN (Re-Export Notification) with the Transhipment service is not covered by this.

If you have any new questions concerning PoUS, please contact our Customer Service.

How do I find out my customer code at the shipping company?

The shipping company will send you your customer code by e-mail. This takes place outside of Portbase's services. You then register this customer code in Cargo Controller or Cargo Release Manager to be verified by the shipping company via the PCS.

How can I register my customer code?

You need to be a main user or a user manager of your IAM organisation to access these functionalities.

Log in to the service Cargo Controller, or Cargo Release Manager, and go to User Menu. Select ' Manage data authorisations'

The screen will open with the tab ' Commercial releases'. Select the shipping company, enter the customer code and click Save.

You will now see the submitted customer codes listed by carrier company name's. The carrier will immediately receive a notification and will review your verification request.

Start Portbase Secure Chain

In consultation with the carrier, you then decide from which date, or for which B/Ls, commercial releases will be issued in Cargo Controller, or Cargo Release Manager, via the PCS. Portbase has no part in this process, this is purely between your organization and the carrier(s). Your customer code must have the status 'Accepted' before the Secure Chain can start.

Manage customer codes

You can have several customer codes per carrier, which you can register individually. In this tab you can see per carrier which customer codes you have registered and you can also manage these by removing expired customer codes using the 'Delete' button.

My customer code has not been verified. What should I do?

As long as your customer code is in the status of 'Pending' or 'Rejected' you cannot start the Secure Chain.

Pending

The carrier has not yet completed your verification, please contact the carrier.

Rejected

Your entered customer code has not been accepted by the carrier. If a customer code is rejected, an explanation will be provided. If you have any questions about this rejection, we advise you to contact the carrier.

Manage customer codes

If you did not enter the customer code correctly, you can easily delete it. To do so, click the Delete-button in the same screen where you entered the customer code for verification.

My customer code has been verified. What happens next?

Start Portbase Secure Chain

In consultation with the carrier, you jointly determine from when the commercial releases will be issued via PCS in Cargo Controller, or Cargo Release Manager. Portbase has no further active role in this, this is done via the shipping company.

Basic functionalities

You can now manage the supply chain to retrieve the relevant containers without PIN code. As usual, you will still receive a delivery note from the carrier by email, but now without a PIN code.

On the current page you will find various FAQs per subject and there we will go into more detail on specific steps in managing your logistics chain within the Secure Chain.

I see that I am no longer assigned for my B/L; how is this possible?

Revoked release

Just as you can revoke the rights of the next party in the chain, your principal in the chain can also revoke this for you as a release-to-party, director or inland operator.

For example, a carrier can withdraw the entire commercial release for the full chain. At that point, the container will no longer be available for collection until the commercial release has been re-issued again.

Your chain may have already been fully prepared, and this chain is still active at this point. Only without the commercial release your inland operator cannot remove the container. If the carrier re-issues the commercial release, this automatically restores your prepared chain and your inland operator can submit the pre-notification.

The same effect can also arise if the validity of your commercial release has expired. Although this is not yet the case at this stage of the Secure Chain, this may change in the future.

Contact your carrier for a new commercial exemption.

Revoked authorization or nomination

Please contact your client if you are no longer authorized or nominated for this cargo.

I see that the validity of the commercial release has expired, now what?

Contact your shipping company for a new commercial release or to renew the commercial release.

If your chain was already fully prepared, it will still be active. But without the commercial release, your haulier cannot unload the container. If the shipping company resends the commercial release, this automatically restores the chain you have prepared and your haulier can submit the prenotification.

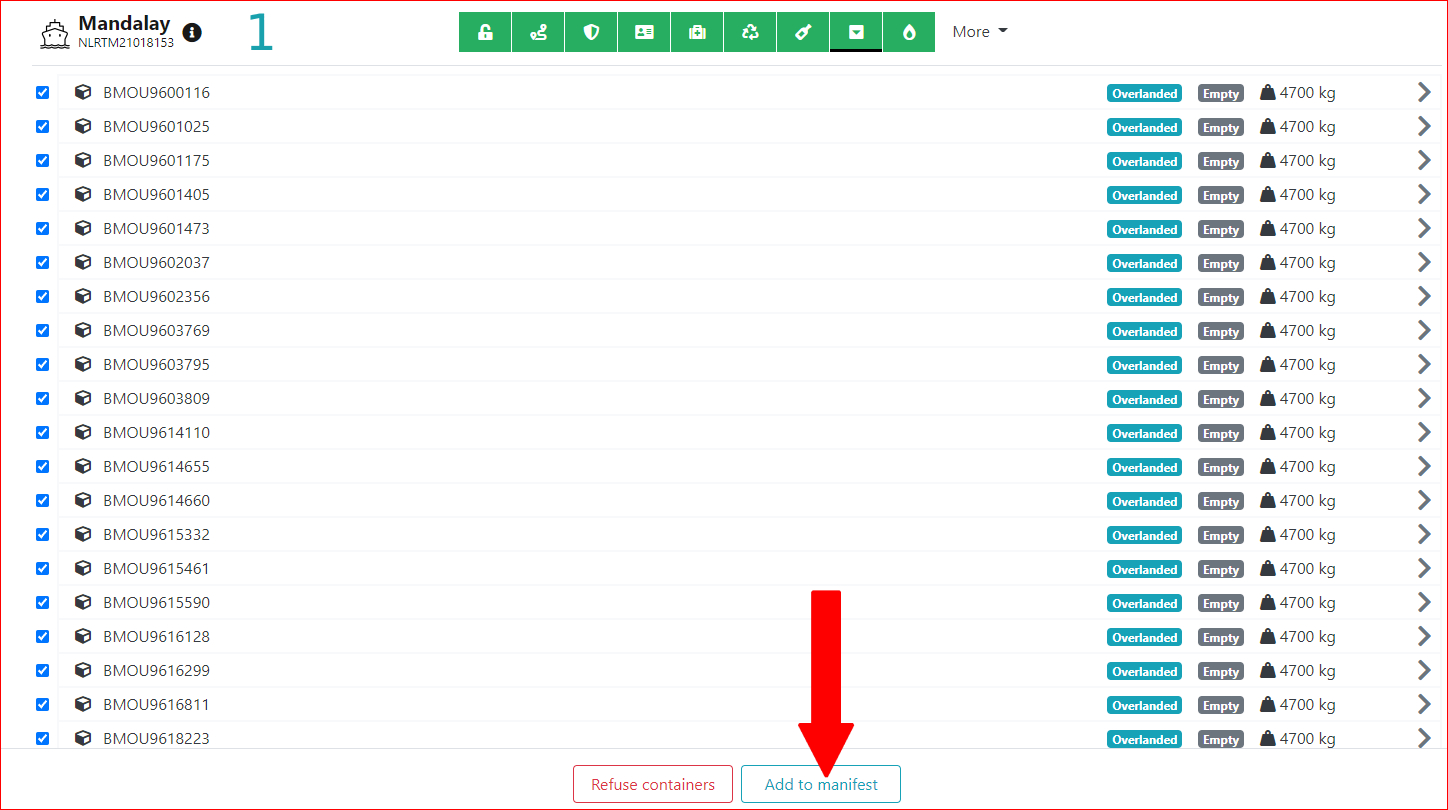

Adding overlanded containers to a manifest (with port of loading selection) in 3 steps.

1 - Select all (or part) and click Add to manifest

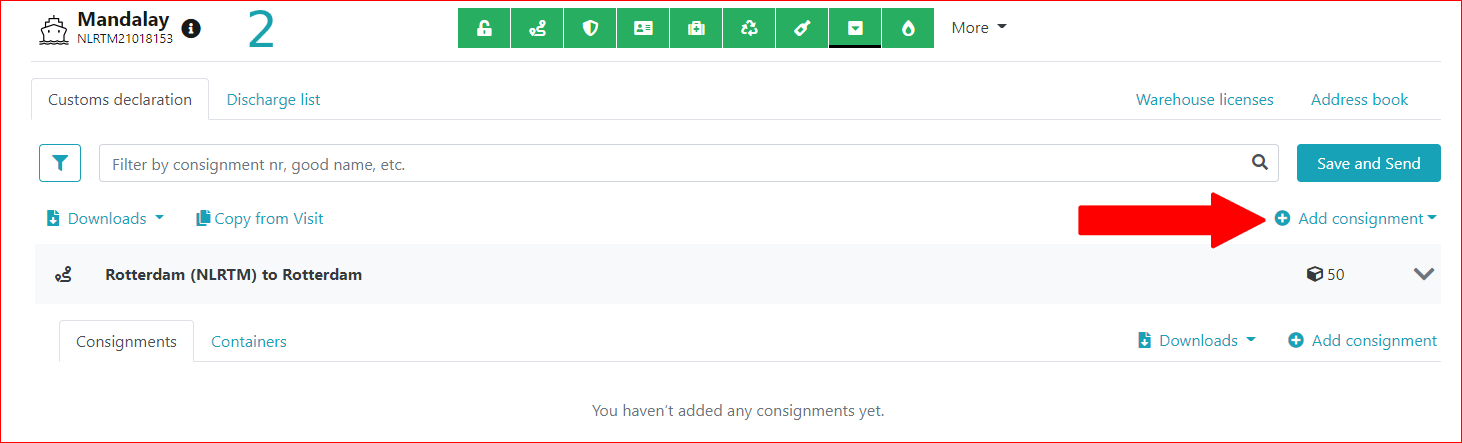

2 - The overlandeds are now out of the picture and must be added to a consignment => click on Add consignment.

=> consignment entry screen opens.

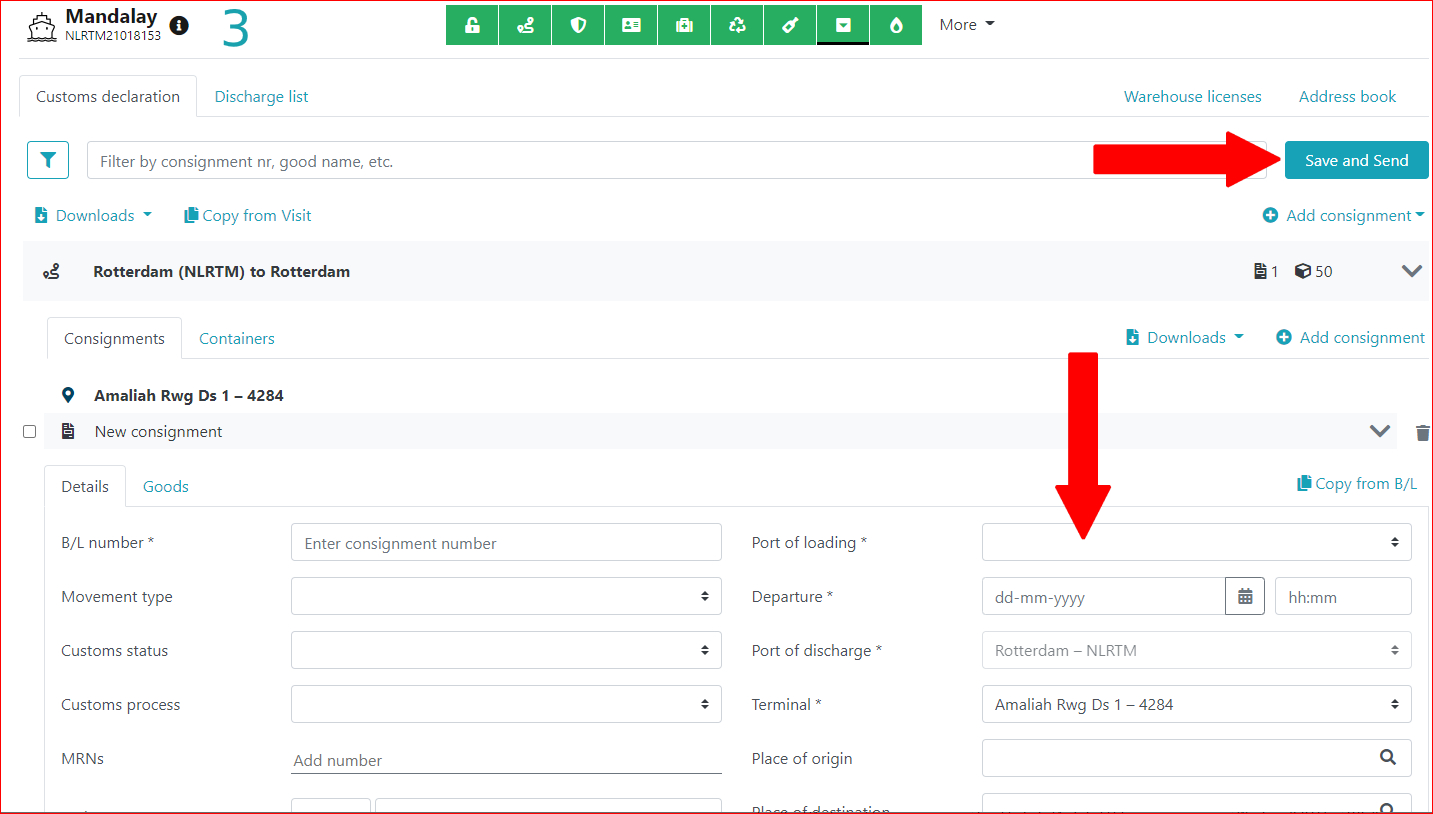

3 - Fill in all necessary and desired details (e.g. choose a port of loading) and click on Save en Send.

How should I submit my empty containers?

Empty containers should always be submitted with a 4 in the EQD segment. If they are submitted with a 5, it means they are full.

An example of an empty container;

EQD+CN+GESU4675537+4EG1+2++4'

You must declare all containers as either empty or full on one B/L. Please note: no mixed B/L with full and empty containers. Outgoing to Customs, this will be entered in the process as 'E', provided no other status is entered in the screen for custom status.

How should cargo that stays within the port be reported?

If, for example, cargo is loaded at ESSO and then unloaded at VOPAK, this does not have to be reported in the PCS.

However, a transport document will have to be created.

How do I report a next vessel under transhipment container in IFTMCS?

If you want to add the data for the connecting feeder to the IFTMCS message, you can do so in the TPL segment.

Only the means of transport and the transport means name are extracted. We do not use any of the other fields.

TPL+SEA:::VSZP7'

It is not possible to add the voyage number. We have agreed with ECT Delta Terminal that instead of the vessel name, the radio call sign can be entered in this field. In the TPL segment, you only specify the follow-up modality. If you want to specify a next vessel, fill in the combination with the call sign or vessel name.

Allowed values are converted to the domain values of the Mode_of_Transport domain:

BARGE = 8 (inland water transport)

RAIL = 2 (rail transport)

SEA = 1 (maritime transport)

TRUCK = 3 (road transport)

Until what point can I amend a manifest?

Every import manifest sent to Customs can be amended up to 90 days after arrival and forwarded to Customs. Changes can be made without proof within 72 hours. After 72 hours, Customs may request more information.

Which code should I use for breakbulk?

You can use the following codes for breakbulk:

How should I declare the cargo if cargo is being transferred?

You should enter it in the import manifest as transhipment/sea in sea out. The outgoing agent must enter it in the export manifest.

In the IFTMCS, the code 27 must be added in the GOR segment. The GOR segment will look like this:

GOR++:::C’ For community cargo, use

GOR++:::N27+:::27’ For community transhipment cargo, use

GOR+++:::27’ For non-community transhipment cargo, use

GOR++:::T1’ For cargo for which there is a T1 on board, use

Change to cargo declaration import internet Japan

The European Union and Japan recognise each other's safety programmes. If you have an AEO Customs Simplification and Safety certificate and you are dealing with goods shipments to Japan, you will be subject to fewer inspections by Customs. The same applies to Japanese AEO exporters who export goods to the EU. In consultation with Customs, the European Commission has designed a temporary solution for you.

If you wish to benefit from this mutual recognition between the European Union and Japan, you must enter the code Y031 and the unique identification number (Y031 + JP ID) of the Japanese AEO company in your entry summary declaration and the temporary storage summary declaration under the heading 'Produced documents/certificates'. Customs uses this code to identify certified companies from Japan.

The above arrangement applies to your entry summary declarations (ENS) and discharge summary declarations (SAL).

To submit summary declarations to Customs, you can use the service Pre-arrival Cargo Declaration Import (4 hours) and/or Cargo Declaration Import Internet via Portbase. Portbase will ensure that if you wish to make use of this arrangement, you can enter this information in the web screen as of 1 June 2012.